The case for

investment in NCD prevention and control in the Philippines.

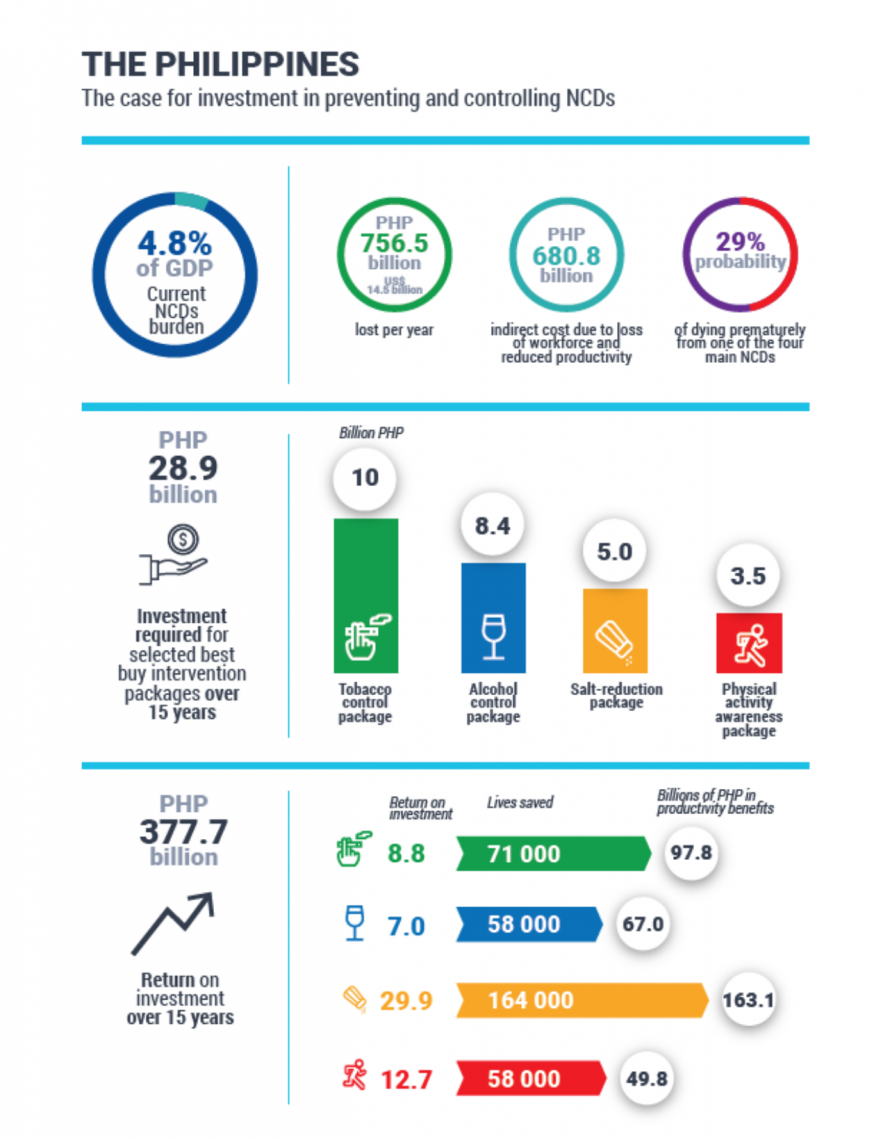

Source: WHO, UNDP

The Philippines

needs to redirect its health care strategies in order to combat

non-communicable diseases (NCDs), such as cancer and heart disease,

which account for 68 percent of all deaths in the country and impose

an enormous burden on the economy.

The

economic cost of NCDs to the Philippine economy is P756.5 billion a

year, which is equivalent to 4.8 percent of the country’s annual

gross domestic product, according to a joint study by the World

Health Organization (WHO) and the United Nations Development Program

(UNDP).

Realizing the

economic benefits of investing on measures to combat NCDs among

Filipinos, the Department of Health (DOH) will redirect and

strengthen interventions to prevent and control non-communicable

diseases that cause death to one out of three Filipinos aged 30 to 70

years old.

“This

investment case which we are launching today aims to serve as a guide

in prioritizing and/or redirecting strategies and interventions. We

do not have to reinvent the wheel, so to speak. Rather, we could

capitalize or build on and strengthen what already exists,” Health

Secretary Francisco Duque III said during the launch of the study

Oct. 29.

Cancer, heart

diseases, diabetes, and chronic respiratory diseases are the four

main NCDs in the country. These are caused by a number of risk

factors, with tobacco use, harmful alcohol intake, physical

inactivity, unhealthy diet, and some metabolic risk factors such as

high blood pressure, obesity, and high cholesterol levels topping the

list.

The cost of the

care and treatment of NCDs accounts for 30 percent of the total

government expenditure on health, but more than the direct expenses

in combatting the diseases, it is the indirect cost which causes the

greater economic burden, the study shows.

In 2017, for

example, P75.7 billion was spent by the government on NCD treatment.

However, a resounding P680.8 billion was lost to diabetes and

cardiovascular diseases alone, through the absenteeism, presenteeism

(or being present at work but with reduced productivity), and

premature death (or death before reaching 70 years old) in the

country’s labor force.

High salt

consumption

High salt content

in food products is a major factor in the high rate of NCD cases in

the Philippines.

“This

investment case had been developed in about 20 countries now. Salt

consumption in the Philippines is about two times higher than the WHO

recommended level. WHO recommended level is two grams of sodium per

day, which is about five grams of salt. In the Philippines, it’s

about twelve grams of salt per day,” said Dr. Alexey Kulikov of the

UN Inter-agency Task Force on the Prevention and Control of

Non-communicable Diseases.

Salt content in

food exceeding the recommended level seems to be common among many

countries, he added, pointing out that other countries have started

reformulating recipes of their food, such as bread, to reduce its

sodium content.

Kulikov warned

that this intervention needs to be done gradually, with the

government and private sector working together.

Duque, in a talk

with reporters, said imposing a tax on salty food could curb

excessive salt consumption, a strategy that worked in the case of

taxes levied on so-called six products such as alcohol and cigarette.

Among the

recommended interventions presented in the investment study, the

salt-reduction policy package poses the highest return on investment

(ROI) in the long run. A Philippine peso allotted for this

intervention assures a return of P11.5 in five years, and P29.9 in 15

years. This package includes front-of-pack labelling of food

products, harnessing industry for reformulation of salt content in

food, and salt-reduction strategies in community-based eating spaces.

The tobacco

control package, on the other hand, ranks second in the interventions

with the highest ROI. This includes raising taxes on tobacco,

monitoring of tobacco use among Filipinos, formulation of tobacco-use

prevention policies, emphasizing warning labels in tobacco products,

enforcing restriction of tobacco access among the youth, and putting

a ban on tobacco advertising.

The other

intervention packages in the report are on alcohol control, physical

activity awareness, and clinical intervention. Investing in these

packages would be able to save about 400,000 lives in 15 years, the

report pointed out.

Preventive health

care

Some of these interventions are already being observed in the

country. Taxes on tobacco and liquor, for example, are already

included in the Sin Tax Reform Law. The tax on sweetened beverages,

on the other hand, is covered by the controversial Tax Reform

Acceleration and Inclusion (TRAIN) Law. The government also has set

guidelines on how to properly put front-of-pack labels on prepackaged

food.

In addition, the

DOH foresees the impact of the reforms that the implementation of the

Universal Health Care (UHC) Law would bring the health sector in the

coming years.

“We expect

to have a health system anchored on primary health care shifting

focus from curative to preventive, as well as promotive care,”

Duque said.

The UHC Law, in

one of its provisions, aims to transform the Health Promotion and

Communications Services of the DOH into a Health Promotion Bureau

which would be tasked to promote health literacy among Filipinos, an

aspect deemed important by Health Undersecretary Dr. Myrna Cabotaje.

“So, in the

next year, when we are full blast with our Universal Health Care,

health promotion will be emphasized. And we need to invest also.

Although (expensive) in terms of resources, but when you invest in

health promotion, then we can prevent disease occurrence, and we can

prevent complications of disease,” she said.

The health

promotion bureau will be tasked to fulfil the last recommendation in

the investment report: the establishment of a “national

multisectoral NCD coordination mechanism” which would “strengthen

national coordination and planning for preventing and controlling

NCDs.”