As the Senate Jan. 29 deliberated on bills to increase tobacco excises, Sen. Richard Gordon called out the Department of Health and said it should have “concrete programs” to make sure people benefit from taxes.

Gordon’s Twitter account posted:

“Umaangal na ang tao na puro tayo tax pero hindi naman umaabot sa kanila ang benepisyo nito. Kailangan may konkretong programa ang DOH kung saan dadalhin ang tax na idadagdag sa tobacco products. Baka kung saan na naman dalhin ang tax ng tao (People are complaining they are not reaping the benefits of taxes. The Department of Health should have concrete programs to show where they would allocate additional taxes on tobacco products. What if taxes get spent elsewhere).”

“We’ve already learned during the Dengvaxia fiasco and even the multi-billion worth barangay health centers. Let us not make the same mistakes again. This is the people’s taxes, it should benefit even the poorest of the poor, not only the rich ones.”

Source: Twitter.com, @DickGordonDG, Jan. 29, 2019

Gordon singling out the health department makes sense; the country’s current sin tax law is primarily a health measure.

Yet, the senator’s post leaves out an aspect of the law that also involves billions in funds.

Sin taxes for health

Republic Act No. 10351, the Sin Tax Reform Law signed by former president Benigno Simeon Aquino III in 2012, raised taxes levied on “sin products” like alcohol and tobacco.

Its aim is twofold: curb consumption and generate more funds for health care.

A 2018 National Tax Research Center report showed total excise taxes collected on sin products reached P105 billion in 2013, P120 billion in 2014, P142 billion in 2015, P145 billion in 2016 and P150 billion in 2017.

Under the sin tax law, 85 percent of the total incremental revenues from excises are programmed into the DOH budget, and since 2015 has made up 40% or more of the department’s total budget.

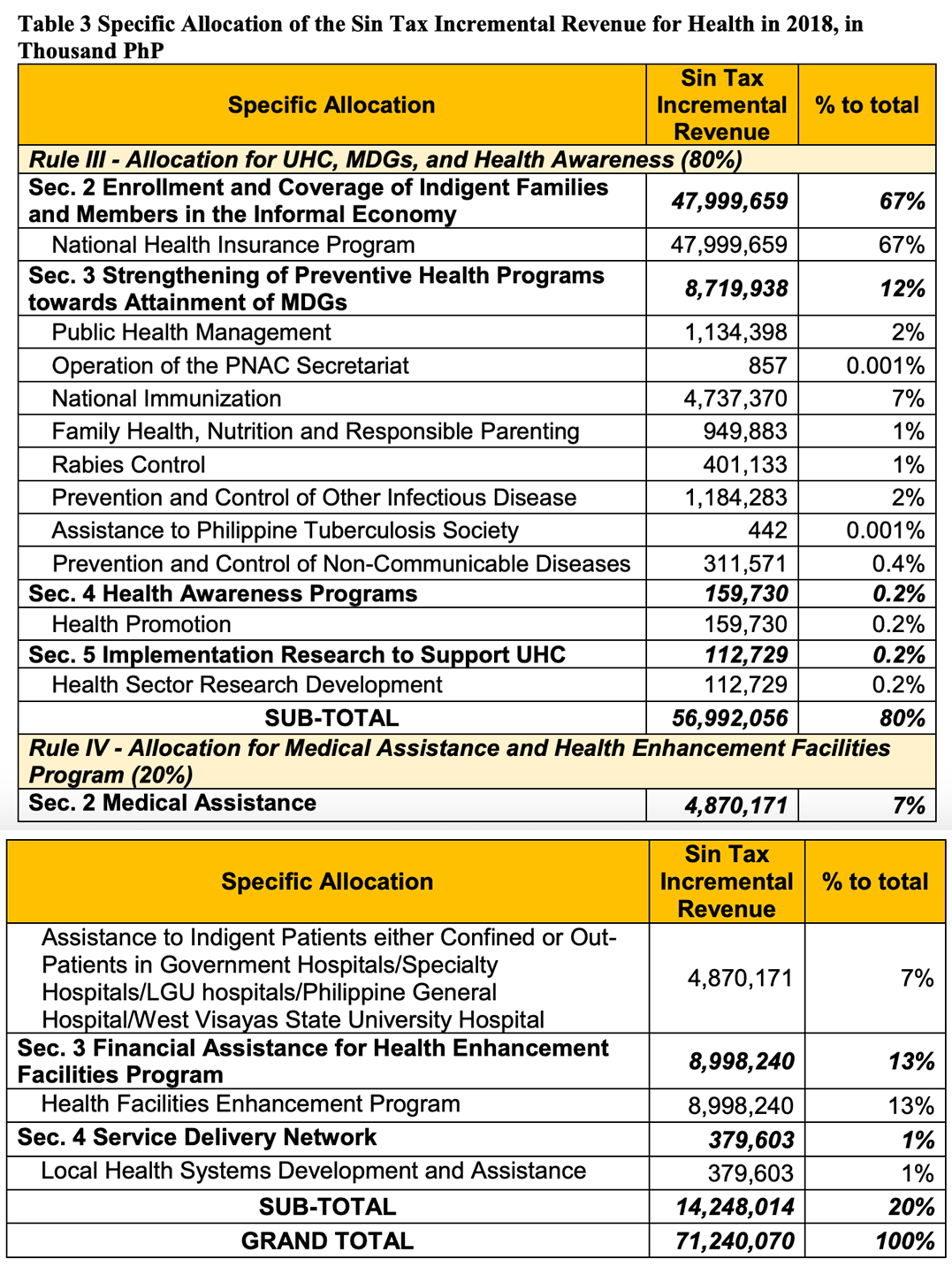

A 2018 annual report showed the health department received P31 billion in sin tax incremental revenues in 2014, P34 billion in 2015, P63 billion in 2016 and P71 billion in 2018.

These were allocated to health insurance for poor families, medical assistance and health awareness programs as specified in the implementing rules and regulations of the sin tax law.

Sin taxes for livelihood

On top of being a health measure, the sin tax law entitles local government units the remaining 15 percent share, supposedly for programs to encourage farmers to shift to other forms of livelihood.

A 2018 VERA Files report showed that in 2016 and 2017, local government shares in sin taxes reached more than P41 billion from collections dating back to 2011.

At least 18 provinces and their cities and municipalities benefited from the windfall of excise tax shares since 2016, the biggest recipients being Candon City, the municipalities of Cabugao and Sta. Cruz in Ilocos Sur, and Balaoan in La Union with P1 billion each.

Compared to the health department’s share programmed into specific expenditure items set by law, funds for tobacco-producing provinces remain unchecked, as local governments have failed to adequately disclose how they spend funds. See Use of billions in tobacco excise tax unchecked

The bulk of excise tax shares appears to have been spent on infrastructure projects that may not have necessarily benefited farmers. See Ten years since smoking regulation law, farmers still stuck with tobacco

Separate rules also govern the sharing scheme for Virginia-type cigarettes and burley and native tobacco; before 2013, congressional districts received their own shares, a form of “pork barrel” disbursement to legislators declared unconstitutional by the Supreme Court. See Like Arroyo, Aquino gov’t releases billions to LGUs before elections

Allegations of fund misuse and corruption have also been reported. See Tobacco farmers yet to feel benefits of excise tax shares

Three Senate bills currently seek to raise the current excise tax rate to as much as P60 to P90 per pack of cigarettes, with provisions for an annual increase of nine percent. House Bill No. 8677 provides a lower rate of P37.50 from the current P35 per pack.

All proposals maintain the revenue allocation scheme prescribed by Republic Act No. 10351.

Sources

Congress of the Philippines, House Bill No. 8677

Department of Budget and Management, Update on the Status of Allocation to Local Government Units

Department of Finance, Annual Report 2017

Department of Finance, Sin Tax Reform

Department of Health, Sin Tax Incremental Revenue Annual Report 2018

House of Representatives, House panel approves increase on tobacco excise tax to P45 by 2022, Nov. 27, 2018

National Library of the Philippines, Joint Resolution No. 001-2014

National Tax Research Center, A Review of Excise Taxation of Sin Products

Official Gazette, Republic Act No. 10351

Senate of the Philippines, Senate Bill No. 1605

Senate of the Philippines, Senate Bill No. 1599

Senate of the Philippines, Senate Bill No. 2177

(Guided by the code of principles of the International Fact-Checking Network at Poynter, VERA Files tracks the false claims, flip-flops, misleading statements of public officials and figures, and debunks them with factual evidence. Find out more about this initiative and our methodology.)